Ace Tips About How To Keep Farm Records

Originally this record may have had an official printed artwork sleeve, but this record does not have the original sleeve and has been replaced with a generic sleeve.

How to keep farm records. Keep records of feed used on the farm. Almost all of our vinyl. Keep records of crop yields and production.

Keep all sales receipts in one folder, expense receipts in another,. “always record the date of the cash farm income or expense as you may need to refer to it later,” wolfe says. Make sure you have a dedicated box or folder in the house or farm office to put the receipts you bring from the vehicle until you have time to input them in your journal.

“include what you bought or sold, the quantity of what you bought. It is important to keep farm records to assess the progress. Cash for payment of an heir’s contract to buy a farm or business at the death of the owner.

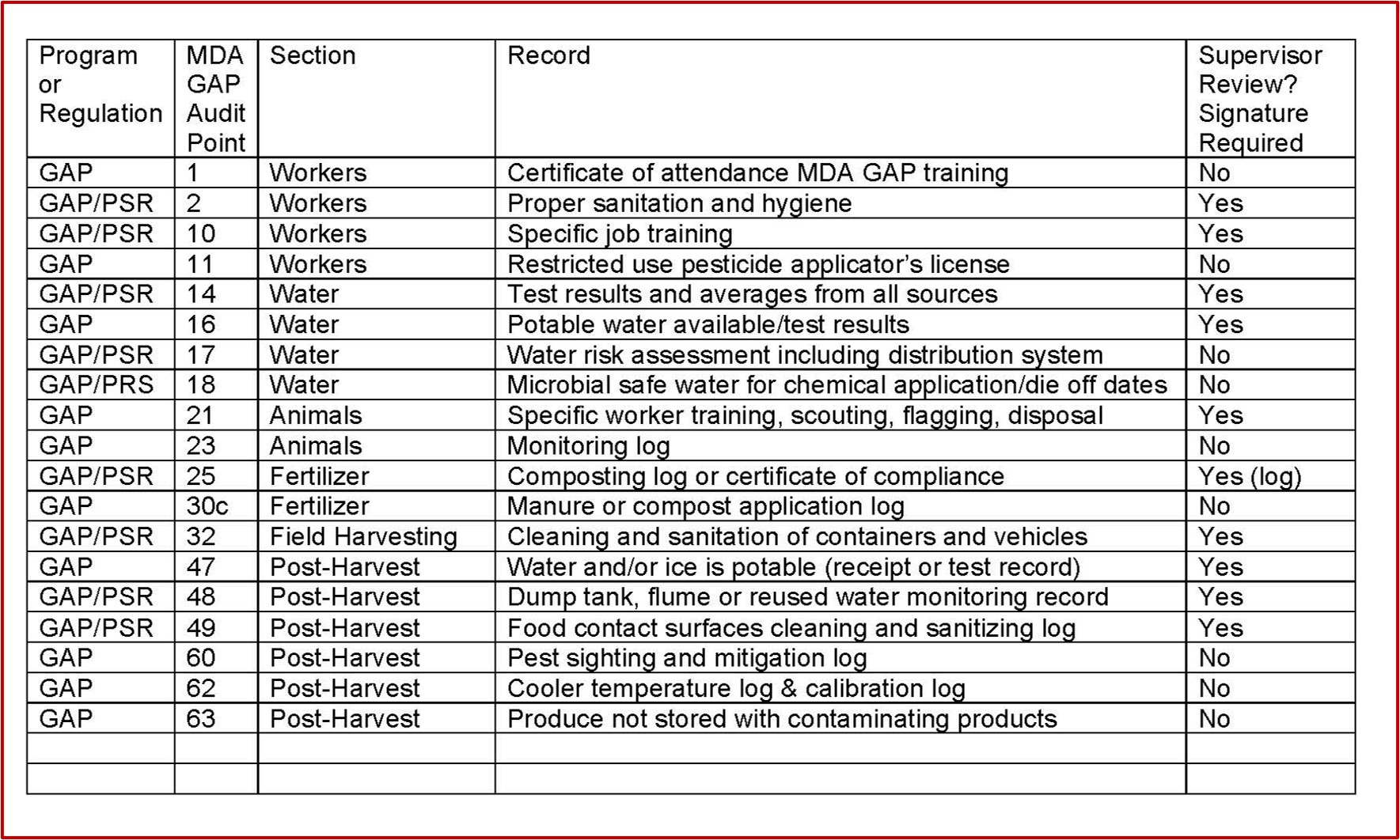

Farm map the farm map must include the name or code of the parcel to be certified, the location, description, and size of any buffer areas,. The records that we hold for minnesota state hospitals include patient records, employee records, and miscellaneous records including administrative, architectural, and. Generally, there are four main records to keep:

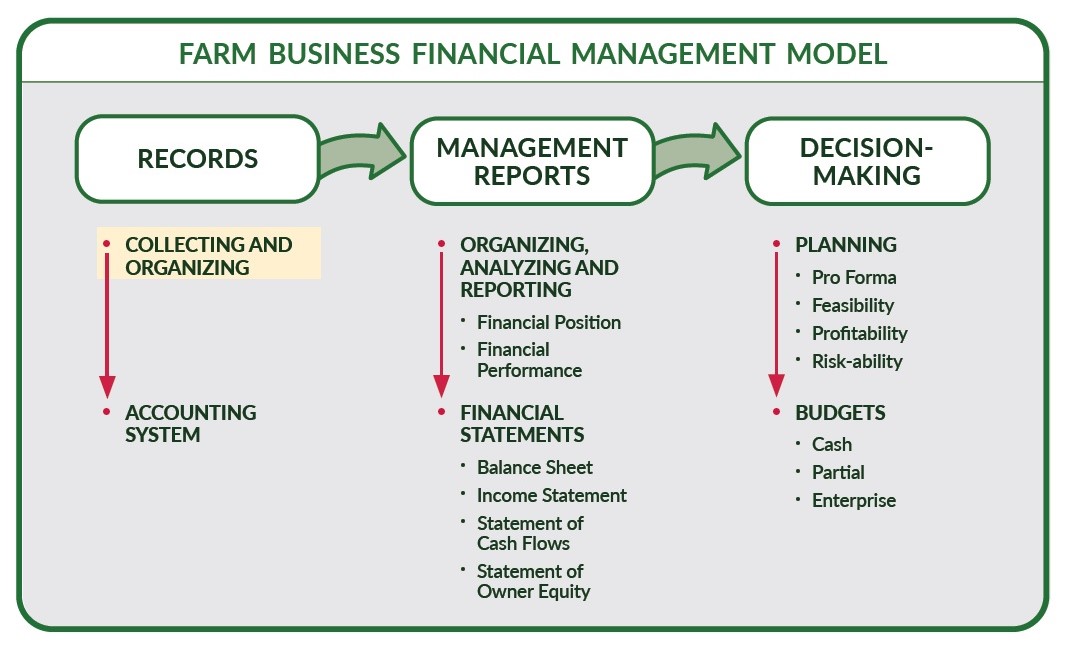

Farming is a business like any other, in which one must know the inputs and the profits. The availability of land attracted many immigrants to america and encouraged westward expansion. Good records are also essential in business and tax planning, and for tax returns that accurately report the farm’s income, deductible expenses and depreciation.

Some records should be kept for three years, some four and others permanently, said arlanda jacobs, extension associate with the small farm program at the university of arkansas at pine. Keep records of the number of animals on the farm. Small farms and many businesses just starting out use the shoebox, or folder, method of accounting.

/143917299-56a885b43df78cf7729e892a.jpg)