Casual Tips About How To Improve Your Credit Score After Bankruptcy

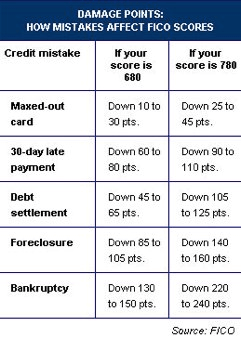

A bankruptcy can remain on your credit report for up to 10 years, and there is a good chance your fico score will be low until you have started rebuilding your credit.

How to improve your credit score after bankruptcy. Find a card offer now. Bankruptcy will only exacerbate your existing credit issues. Take advantage of these autopay features.

It’s important to note that your credit score will decrease when you open new accounts. Wait it’s going to take. A good rule of thumb for interest payments is that you should try to avoid any interest rate that is higher than the rate you could reasonably expect to earn by investing your.

Become an authorized user on someone elses card if you have a relative or friend who has really good credit and. It is common for people’s credit scores to drop by 200 points or more following a bankruptcy filing. The next step in rebuilding your credit score will be to obtain some sort of loan.

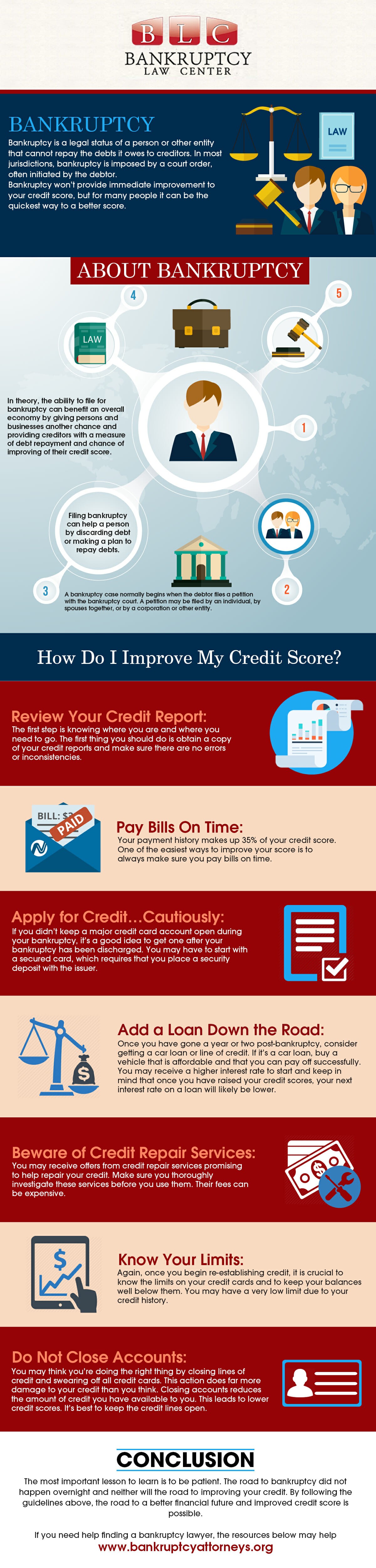

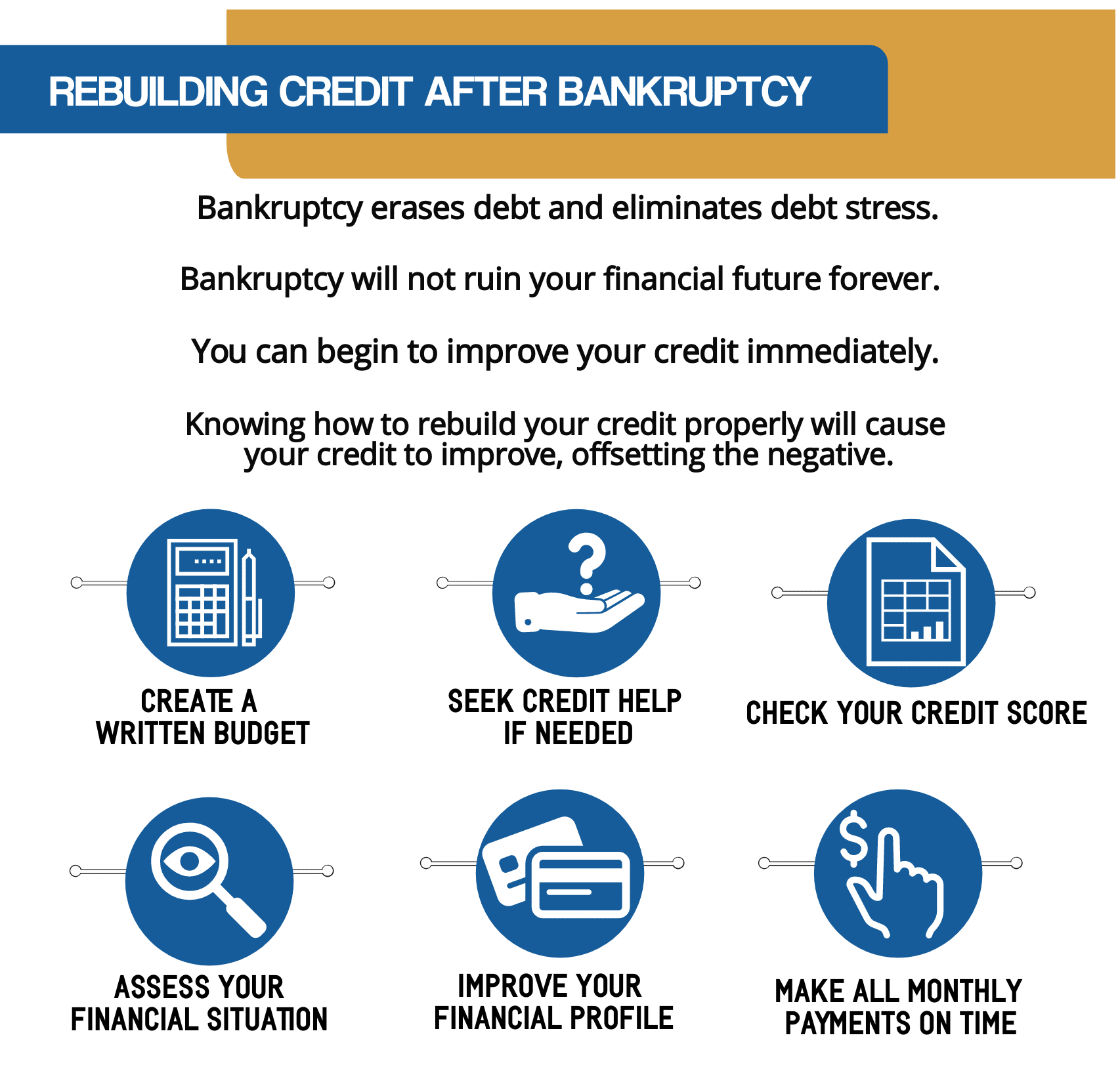

After a bankruptcy it can be difficult to near impossible to get credit, but there is hope, you can improve your credit score over time. Do not close any credit cards simply because you were once bankrupt. Your bankruptcy will appear on your credit report for up.

Request three free credit reports and check that the balance is zero. Set up reminders on your calendar to pay bills every month by the due date. However, what type of bankruptcy filed will factor into your credit score.

Bankruptcy can stay on your credit report for up to 10 years, and your credit score will probably be pretty low after a bankruptcy. They should be marked as discharged and show zero balances. Here’s how to start rebuilding your credit after bankruptcy: